BTC Price Prediction: Navigating the Storm Between Whale Sell-Offs and Institutional Demand

#BTC

- Technical Divergence: Price below MA suggests bearishness, but oversold indicators hint at reversal potential

- Institutional Footprint: Despite sell-off headlines, strategic players are building positions

- Macro Alignment: Fed policy remains the swing factor for 2026 price trajectory

BTC Price Prediction

BTC Technical Analysis: Short-Term Bearish Pressure Amid Long-Term Bullish Signals

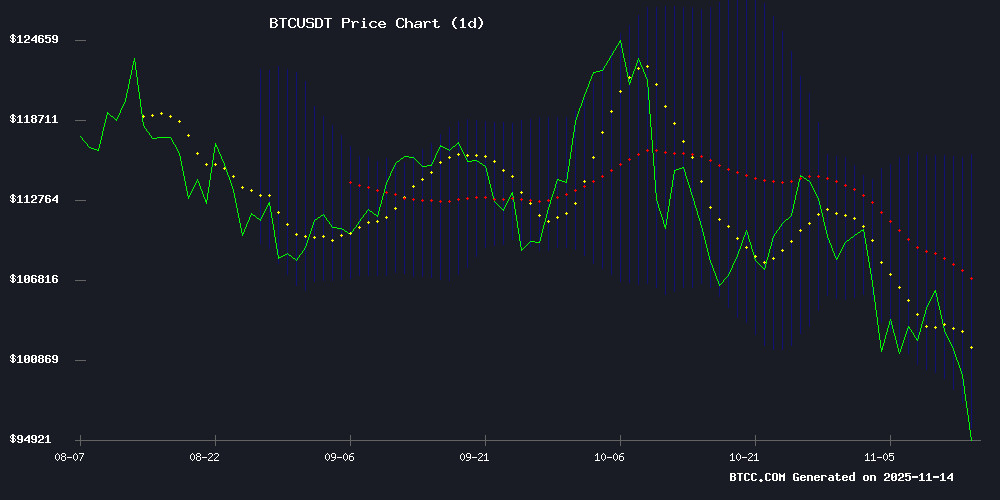

BTCC financial analyst Emma notes that Bitcoin is currently trading at $99,573, below its 20-day moving average of $106,190, indicating short-term bearish pressure. The MACD shows a bullish crossover (4715.42 vs 3521.50), but the histogram is narrowing, suggesting weakening momentum. Bollinger Bands show price near the lower band ($96,856), which could indicate an oversold condition. 'While we're seeing technical resistance at the $100K psychological level,' Emma observes, 'the MACD golden cross and proximity to the lower Bollinger Band suggest accumulation opportunities for long-term investors.'

Market Sentiment: Bearish Headlines Mask Institutional Accumulation

'The current news flow appears overwhelmingly negative,' says BTCC's Emma, citing headlines about whale sell-offs and ETF outflows. 'However, beneath the surface, we're seeing strategic positioning - the EU nations' BTC holdings and Michael Saylor's gold-cap prediction reveal institutional conviction.' The analyst highlights that while retail traders are panicking (Fear & Greed Index at 7-month low), the MOVE of Satoshi-era coins likely represents estate planning rather than bearish bets. 'CryptoAppsy's rise as a trading tool shows sophisticated participants are actively managing positions,' Emma adds.

Factors Influencing BTC's Price

Michael Saylor Predicts Bitcoin Will Surpass Gold's Market Cap by 2035

MicroStrategy Executive Chairman Michael Saylor has doubled down on his bullish Bitcoin stance, forecasting the cryptocurrency will eclipse gold's market capitalization by 2035. His prediction hinges on Bitcoin's programmed scarcity, with 99% of supply mined by that year—an event he terms the "0.99 year." The remaining 1% will enter circulation over the following century.

MicroStrategy's aggressive accumulation strategy now holds 641,692 BTC, representing approximately 3% of Bitcoin's total supply. Saylor frames this as a "digital gold rush," emphasizing Bitcoin's trifecta of value drivers: verifiable scarcity, expanding adoption, and growing global relevance. "I have no doubt Bitcoin will become a larger asset class than gold within the next decade," he told Yahoo Finance.

The commentary comes amid a 12% monthly price decline, with Bitcoin currently trading at $98,638. Despite market turbulence, Saylor maintains institutional conviction remains unshaken. The debate gains further momentum with Binance's CZ and gold advocate Peter Schiff scheduled for a December 2025 showdown on the assets' relative merits.

Bitcoin Tumbles Below $98K as Crypto Stocks Plunge and Fed Rate Cut Hopes Fade

Bitcoin's price plummeted to nearly $98,000 today, marking its third significant drop this month. Over $700 million in long positions were liquidated as November—once anticipated as a bullish month—turns sharply bearish, with BTC down more than 10%.

The sell-off accelerated alongside a broad decline in crypto-related stocks. Cipher Mining led losses with a 14.4% drop, while Riot Platforms, Hut 8, Marathon Digital, and Bitfarms each fell over 10%. Even industry heavyweights like Coinbase and MicroStrategy slid 7%, mirroring a 2% Nasdaq retreat.

Market sentiment soured further as Federal Reserve officials tempered expectations for December rate cuts. The shift toward risk-off positioning hit speculative assets hardest, with traders rapidly unwinding crypto exposures.

Bitcoin Price Dips Below $100K as Whales Offload Holdings

Bitcoin's price slipped below the psychological $100,000 threshold, trading as low as $98,200 before a slight recovery to $98,400. The downward movement reflects aggressive selling by long-term holders, with 815,000 BTC liquidated over the past month.

On-chain data reveals a single whale dumped $290 million worth of Bitcoin via Kraken, exacerbating the sell-off. Meanwhile, capital flows have favored gold and equities over crypto assets, despite the U.S. government reopening.

Leveraged traders suffered $647 million in liquidations, with longs accounting for $519 million. Bitcoin-related positions saw $234 million wiped out as fear of further downside grips the market.

IBIT ETF and Bitcoin Face Bearish Pressure Amid Market-Wide Risk Aversion

The iShares Bitcoin Trust (IBIT) extended its decline, dropping 3% to $55.86 as Bitcoin's price fell 3.03% to $98,578.10. The ETF has lost 4.89% over five days, though remains 8.56% higher year-to-date. Technical indicators show a Strong Sell consensus, with 14 Bearish ratings outweighing 5 Neutral and 3 Bullish calls.

Bitcoin's slide mirrors broader market sentiment, with tech stocks leading the risk-off move. The cryptocurrency now sits 22% below its early October all-time high of $126,000, technically entering bear market territory. Trading activity suggests neutral sentiment among investors, with 1.9% of portfolios holding IBIT exposure.

Despite the downturn, institutional interest persists. The Czech central bank revealed it's building a test portfolio of digital assets for long-term experimentation—a rare bright spot in today's risk-averse climate.

Bitcoin Price Crashes Below $98,000 as Fear & Greed Index Hits 7-Month Low

Bitcoin plunged below $98,000, marking a 3.5% drop in 24 hours as market sentiment crumbles. The Crypto Fear & Greed Index nosedived to 15—its lowest level in seven months—signaling 'extreme fear' among traders. This reading now sits below levels seen during the FTX collapse, reflecting deepening anxiety.

The sell-off coincides with a 43-day U.S. government shutdown that disrupted traditional cash flows, creating liquidity strains across risk assets. On-chain data shows Bitcoin reserves on exchanges are climbing again, suggesting holders may be preparing to offload more coins.

Institutional demand has evaporated, with Bitcoin ETFs bleeding $278 million in outflows on November 12 alone. The product has now seen over $1 billion in withdrawals this month—a stark reversal from earlier bullish positioning.

Bitcoin Price Prediction: Whales Return As Institutional Demand Builds For Spot ETFs

Bitcoin's market turbulence appears to be subsiding as on-chain metrics signal the return of whale activity and growing institutional interest in spot ETFs. The token currently trades at $101,200, with analysts projecting a potential surge to $125,000.

U.S. spot Bitcoin ETFs recorded $524 million in net inflows on November 11th - the highest daily figure since Bitcoin's October 6th all-time high of $126,000. BlackRock's IBIT led with $224.2 million, followed by Fidelity's FBTC ($165.9 million) and Ark Invest's ARKB ($102.5 million).

While institutional money flows into Bitcoin through regulated products, some seasoned investors are diversifying into emerging payment altcoins like RTX, anticipating outsized gains by 2026.

Bitcoin Breaks European Union: Czech Republic and Luxembourg Announce BTC Holdings

European nations are accelerating Bitcoin adoption as a strategic reserve asset, following the lead of the United States under President Donald Trump. Luxembourg and the Czech Republic have emerged as pioneers in this movement, defying traditional financial norms to hedge against inflation and macroeconomic instability.

Luxembourg's sovereign wealth fund has allocated 1% of its assets—approximately €7 million—to Bitcoin, as announced by Finance Minister Gilles Roth at the Bitcoin Amsterdam 2025 conference. "We aim to be at the forefront of this financial evolution," Roth stated, signaling a broader shift among European policymakers.

The Czech National Bank has taken a more provocative stance, creating a test portfolio dominated by Bitcoin despite EU reservations. Governor Aleš Michl revealed plans dating to early 2025, emphasizing rigorous testing of custody solutions and transaction protocols. This move challenges the bloc's cautious approach to cryptocurrency integration.

Cryptocurrency Market Faces Sustained Downturn as Bitcoin Struggles Below Key Threshold

Bitcoin's failure to hold the $102,800 350DMA level signals potential vulnerability in its 1.5-year upward trajectory. The flagship cryptocurrency has dipped below $100,000 for the third time this month, with market sentiment weighed down by fading AI sector enthusiasm and Federal Reserve hawkishness.

Technology stocks' unprecedented rally, fueled by GPT-driven optimism, appears to be losing steam. The market had already priced in the resolution of the government shutdown, removing a potential catalyst. Bitcoin's recent peak at $126,080 occurred 1064 days post-halving, notably later than historical 500-550 day cycle patterns would suggest.

Satoshi-Era Whale Moves $245M in Bitcoin to Kraken, Sparking Sell-Off Speculation

A dormant Bitcoin wallet from the cryptocurrency's early days has transferred 2,401 BTC (worth $245 million) to Kraken exchange. The movement follows internal wallet consolidations earlier this month, suggesting potential preparation for liquidation.

The whale still holds 2,499 BTC ($258.58 million) in remaining balances. These coins were originally accumulated during Bitcoin's infancy, when prices were fractions of current valuations. Market observers note such large exchange deposits often precede sell orders.

Kraken's compliance infrastructure makes it a preferred venue for institutional-scale transactions. The transfer represents one of the largest movements of Satoshi-era coins this year, occurring as Bitcoin consolidates near all-time highs.

CryptoAppsy Emerges as Essential Real-Time Tool for Crypto Traders

CryptoAppsy delivers institutional-grade market monitoring to retail investors through a lightweight mobile application. The platform aggregates real-time pricing data across thousands of assets—from Bitcoin's $102,931 valuation to emerging altcoins—with updates every five seconds.

Unique multi-currency portfolio tracking eliminates manual exchange comparisons, while AI-curated news feeds align with individual asset holdings. Verified users praise the 5.0-rated app's smart alert system that captures arbitrage opportunities during volatile swings.

Bitfarms Announces Strategic Pivot from Bitcoin Mining to AI Infrastructure

Bitfarms, one of North America's largest Bitcoin mining operations, has unveiled plans for a two-year transition from cryptocurrency mining to high-performance computing and artificial intelligence services. The company's Washington State facility will lead this transformation, with a $128 million retrofit to accommodate Nvidia GB300 GPUs and advanced liquid cooling systems.

The shift reflects broader industry trends as crypto miners face compressed margins amid volatile Bitcoin prices. Bitfarms' Toronto operations will pivot toward GPU-as-a-Service offerings, targeting cloud computing opportunities while gradually winding down mining activities. The Washington conversion project, slated for completion by December 2026, represents a fundamental reorientation of the company's business model.

Is BTC a good investment?

Based on current technicals and market dynamics, BTCC's Emma presents a nuanced view:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | -5.8% discount | Short-term oversold |

| MACD | 1193.91 bullish | But momentum fading |

| Bollinger %B | 0.27 | Near oversold territory |

| Key News | Institutional accumulation vs retail panic | |

'The $95K-$100K range represents a high-conviction buying zone for investors with 3+ year horizons,' Emma concludes. 'While volatility will persist due to ETF flows and macro uncertainty, Bitcoin's network fundamentals and adoption curve remain intact.'

Dollar-cost averaging recommended for new investors, with alerts set for a weekly close above $106,190 MA to confirm trend reversal.